Getting declined for a credit card can be frustrating, especially if you were counting on having access to credit. While a rejection can feel discouraging, it’s important to remember that it’s not the end of the road. Understanding why your application was denied and taking proactive steps to improve your financial standing can increase your chances of approval in the future.

In this guide, we’ll explore common reasons why credit card applications get declined and how to improve your approval odds next time you apply.

1. Common Reasons for Credit Card Rejection

Banks and financial institutions evaluate applications based on several criteria. If your application was declined, one or more of the following factors may be to blame.

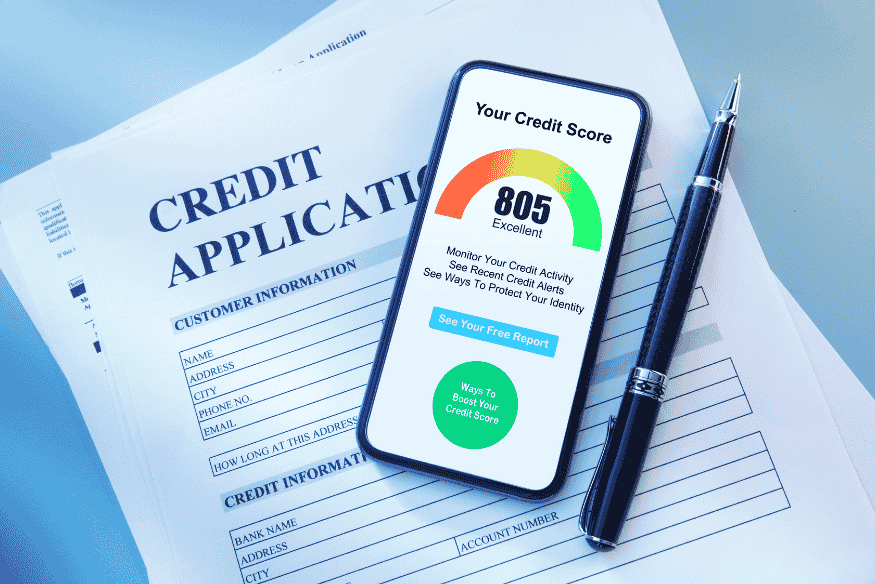

1.1 Low Credit Score

Your credit score plays a major role in whether you’re approved for a credit card. A low score signals a higher risk to lenders.

Why It Matters:

- Many credit cards require a good to excellent credit score (typically 670+).

- A history of late payments, defaults, or bankruptcies can lower your score.

- A thin credit file (not enough credit history) can lead to rejection.

How to Fix It:

- Make on-time payments to improve your payment history.

- Reduce your credit utilization by paying down existing balances.

- Check your credit report for errors and dispute any inaccuracies.

1.2 High Debt-to-Income Ratio

Your debt-to-income ratio (DTI) measures how much of your income goes toward paying debts. Lenders prefer applicants who aren’t overextended financially.

Why It Matters:

- A high DTI suggests you may struggle to take on additional debt.

- Even if your credit score is good, excessive debt can lead to rejection.

How to Fix It:

- Pay off existing debt before applying for a new credit card.

- Increase your income to improve your debt-to-income ratio.

1.3 Too Many Recent Credit Inquiries

Each time you apply for credit, a hard inquiry is placed on your credit report. Multiple inquiries within a short period can make lenders wary.

Why It Matters:

- Too many recent inquiries can temporarily lower your credit score.

- Lenders may see multiple applications as a sign of financial distress.

How to Fix It:

- Space out applications and wait at least 6 months before reapplying.

- Check your credit score requirements before applying to avoid unnecessary hard inquiries.

1.4 Insufficient Income

Lenders set minimum income requirements to ensure borrowers can repay their debts. If your income is too low, you may be rejected.

Why It Matters:

- Credit card issuers want to see stable and sufficient income.

- Some premium credit cards require a higher income threshold.

How to Fix It:

- Apply for a credit card that matches your income level.

- Consider increasing your income through side jobs or asking for a raise.

1.5 Limited or No Credit History

If you’ve never had a credit card or loan, banks may hesitate to approve your application due to a lack of credit history.

Why It Matters:

- Lenders prefer applicants with an established track record of responsible credit use.

- A lack of history makes it difficult to assess your financial habits.

How to Fix It:

- Start with a secured credit card or credit-builder loan.

- Become an authorized user on a trusted person’s credit card.

2. What to Do If Your Credit Card Application Is Declined

If your application was rejected, follow these steps to improve your chances next time.

2.1 Review the Rejection Letter

When your application is declined, the issuer must send you a notice explaining the reason. This letter provides valuable insight into why you weren’t approved.

What to Look For:

- Specific reasons for denial (e.g., low credit score, high DTI, etc.).

- Which credit bureau was used (so you can check your report for issues).

2.2 Check Your Credit Report

Your credit report provides a detailed look at your credit history. You can obtain a free copy from major credit bureaus such as Experian, Equifax, and TransUnion.

What to Look For:

- Errors in your credit report that may be unfairly impacting your score.

- Outstanding debts that should be paid down.

- Late payments or other derogatory marks that need improvement.

2.3 Improve Your Financial Profile

If your credit score or financial situation led to the rejection, focus on strengthening your financial profile.

Ways to Improve:

- Pay bills on time to boost your credit score.

- Lower your credit utilization ratio by paying down balances.

- Avoid opening too many credit accounts at once.

2.4 Consider Alternative Credit Options

If you were declined for a traditional credit card, you may still qualify for alternative credit-building options.

Other Credit-Building Options:

- Secured Credit Cards – Require a refundable deposit and help build credit.

- Credit-Builder Loans – Small installment loans designed to establish credit.

- Retail Store Cards – Easier to qualify for and can help build credit.

2.5 Contact the Credit Card Issuer

If you believe the rejection was unfair or based on incorrect information, you can contact the credit card issuer and request reconsideration.

What to Say:

- Politely ask for a manual review of your application.

- Explain any mitigating circumstances (e.g., recent debt repayment, job change, or credit report errors).

- Offer to provide additional documentation to support your case.

3. When Should You Reapply for a Credit Card?

Timing matters when reapplying for a credit card. Applying too soon can lead to another rejection, further lowering your credit score.

Best Practices for Reapplying:

- Wait at least 6 months before reapplying for a similar card.

- Focus on improving your credit score in the meantime.

- Consider applying for a card with lower requirements if your profile still needs improvement.

Conclusion

Having a credit card application declined is not the end of the world. It’s an opportunity to assess your financial situation, improve your credit profile, and reapply strategically. By understanding the reasons for rejection and taking proactive steps, you can increase your chances of approval in the future.

Instead of viewing a rejection as a failure, use it as a learning experience to build better financial habits and secure a credit card that fits your needs.